100 Sentences of Money in English

What is Money?

Money is a medium of exchange that is widely accepted in transactions for goods and services. It is a standardized and universally recognized form of currency that can be used to purchase goods and services and pay debts. The use of money simplifies transactions by eliminating the need for bartering and allows for a more efficient and organized economy. Money can take many forms, including physical currency, coins, digital or electronic currency, or bank deposits. The value of money is determined by various factors such as supply and demand, economic stability, and government policies.

The History of Money

The history of money can be traced back thousands of years, to the time when people first started trading goods and services. In the early days, bartering was the most common form of exchange, with people trading goods and services directly for other goods and services. This was inefficient, as people often needed to find someone who had exactly what they wanted and was willing to trade it for what they had.

To overcome this problem, some societies started using commodity money, such as cattle, grains, and precious metals, as a form of exchange. These commodities had intrinsic value, so they could be used to buy goods and services. Over time, precious metals like gold and silver became the most widely used commodity money, as they were rare, easily divisible, and easily transportable.

In modern times, paper money was introduced and backed by a government’s promise to exchange it for a specified amount of precious metal. With the rise of centralized governments, the supply of money became controlled by the state, leading to the development of fiat money, which is the currency that has value because the government says it does. Today, most money is digital or electronic, with physical currency representing a small fraction of the money supply.

The evolution of money has been a long and complex process, with different societies and governments adopting various forms of currency throughout history. The history of money is a testament to the ingenuity of humanity and the continuous pursuit of more efficient and convenient ways of exchanging goods and services.

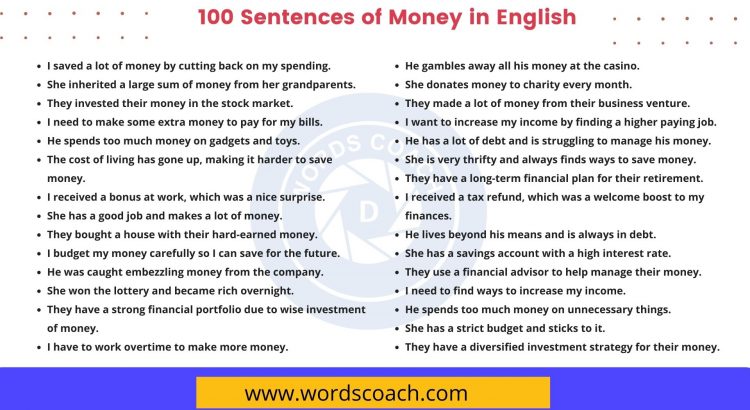

100 Sentences of Money in English, Money Example Sentences

Here are 100 Sentences of Money in English

- I saved a lot of money by cutting back on my spending.

- She inherited a large sum of money from her grandparents.

- They invested their money in the stock market.

- I need to make some extra money to pay for my bills.

- He spends too much money on gadgets and toys.

- The cost of living has gone up, making it harder to save money.

- I received a bonus at work, which was a nice surprise.

- She has a good job and makes a lot of money.

- They bought a house with their hard-earned money.

- I budget my money carefully so I can save for the future.

- He was caught embezzling money from the company.

- She won the lottery and became rich overnight.

- They have a strong financial portfolio due to wise investment of money.

- I have to work overtime to make more money.

- He gambles away all his money at the casino.

- She donates money to charity every month.

- They made a lot of money from their business venture.

- I want to increase my income by finding a higher paying job.

- He has a lot of debt and is struggling to manage his money.

- She is very thrifty and always finds ways to save money.

- They have a long-term financial plan for their retirement.

- I received a tax refund, which was a welcome boost to my finances.

- He lives beyond his means and is always in debt.

- She has a savings account with a high interest rate.

- They use a financial advisor to help manage their money.

- I need to find ways to increase my income.

- He spends too much money on unnecessary things.

- She has a strict budget and sticks to it.

- They have a diversified investment strategy for their money.

- I try to save 10% of my income each month.

- He lost a lot of money in the stock market crash.

- She invests in real estate to grow her wealth.

- They have a retirement plan in place to ensure financial security.

- I want to build an emergency fund to cover unexpected expenses.

- He has a lot of credit card debt and is trying to pay it off.

- She is careful with her money and doesn’t waste it on frivolous things.

- They have a good credit score, which helps them secure loans for big purchases.

- I try to limit my monthly expenses to stay within my budget.

- He uses coupons and discounts to save money on groceries.

- She has a solid financial plan for her future.

- They have a balanced portfolio of stocks, bonds, and real estate investments.

- I need to start saving for my children’s education.

- He has a habit of impulse buying, which is damaging to his finances.

- She has multiple sources of income to increase her wealth.

- They have a strong financial foundation due to careful management of their money.

- I want to start a savings plan for my retirement.

- He takes on too many loans and is unable to repay them.

- She has a savings account specifically for unexpected expenses.

- They have a budgeting app to help manage their money more effectively.

- I need to reduce my debt to improve my financial situation.

- He splurges on expensive vacations, which strains his finances.

- She is a savvy shopper and always looks for sales and deals to save money.

- They have a system for tracking their income and expenses to stay on top of their finances.

- I want to increase my savings rate to reach my financial goals faster.

- He has a history of poor money management and is trying to turn things around.

- She uses her money wisely and avoids making impulsive purchases.

- They have a financial plan that takes into account their short-term and long-term goals.

- I need to be more mindful of my spending habits to reach my financial goals.

- He has a lot of student loan debt and is trying to pay it off as soon as possible.

- She uses her money to invest in her personal and professional development.

- They have a balanced approach to spending and saving, which helps them maintain their financial stability.

- I want to start a side hustle to supplement my income.

- He has a tendency to overspend and needs to be more disciplined with his money.

- She has a system for managing her finances and is able to save a lot of money each month.

- They have a financial advisor to help them make smart investment decisions.

- I need to start planning for my future and setting financial goals.

- He needs to prioritize paying off his debt over making unnecessary purchases.

- She has a strong work ethic and uses her money to further her career goals.

- They have a strong understanding of personal finance and are able to make informed financial decisions.

- I want to build my wealth by investing in the stock market.

- He has a lot of consumer debt and is trying to pay it off as soon as possible.

- She uses her money to travel and experience new cultures.

- They have a savings account specifically for their children’s education.

- I need to be more responsible with my money and avoid frivolous spending.

- He needs to start saving for his future instead of living for the present.

- She has a strong financial education and is able to make smart money decisions.

- They have a system for allocating their money for various expenses and savings.

- I want to start a business and be my own boss.

- He has a habit of overspending on luxury items and needs to be more mindful of his spending.

- She has a solid emergency fund to cover unexpected expenses.

- They have a retirement plan that takes into account their current financial situation and future goals.

- I need to find ways to reduce my expenses to increase my savings.

- He needs to be more careful with his money and avoid taking on too much debt.

- She uses her money to support her favorite causes and charities.

- They have a system for tracking their expenses and keeping their spending in check.

- I want to start a passive income stream to supplement my salary.

- He has a lot of financial worries and needs to be more proactive about managing his money.

- She has a strong understanding of the importance of saving and investing for the future.

- They have a well-diversified investment portfolio to grow their wealth.

- I need to be more disciplined with my spending and avoid impulse purchases.

- He needs to make a budget and stick to it to improve his financial situation.

- She has a plan for paying off her debt and improving her credit score.

- They have a retirement plan that includes both traditional and alternative investments.

- I want to increase my income by taking on freelance work or starting a side business.

- He needs to focus on reducing his expenses and cutting back on unnecessary spending.

- She has a system for monitoring her credit score and making sure it stays in good standing.

- They have a budgeting app to help them stay on top of their finances and manage their spending.

- I need to make sure I have enough money saved for emergencies and unexpected expenses.

- He has a goal to become financially independent and retire early.

- She uses her money to create memories and experiences that are meaningful to her.

The importance of money in our daily lives cannot be overstated. Money is a medium of exchange that has greatly facilitated trade and commerce throughout history. A comprehensive understanding of money, its uses, and its evolution can be useful in managing one’s own finances and making informed decisions about spending, saving, and investing. Whether it’s setting financial goals, creating a budget, or investing in a retirement plan, the use of money is a fundamental part of our lives and is essential to achieving financial security and independence.